Your wealth may be largely concentrated in your business. Just as your aspirations have guided you in the evolution of your business – we aspire to help create additional value and ultimately exit your business in the best possible fashion.

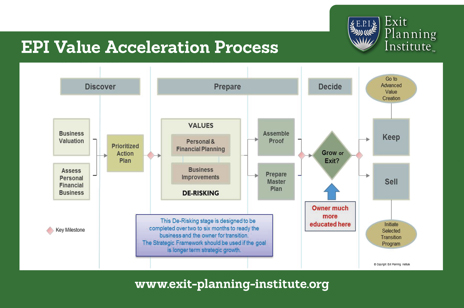

We are Certified Exit Planning Advisors (CEPA) with the Exit Planning Institute. CEPAs follow a process for exit planning known as the Value Acceleration Methodology:

The EPI Value Acceleration Methodology as used by NorthBridge Business Advisors is grounded in the understanding that 25% of privately owned businesses successfully sell. On top of that, a Price Waterhouse study conducted several years ago showed that 75% of business owners who successfully sold their business, seriously regretted doing so in the year following the sale. Those statistics indicate that only 6.25% of business owners successfully sell their business and are satisfied that they did so a year later! NorthBridge Business Advisors is committed to beating those odds – by A LOT.

The process we have adopted by the Exit Planning Institute is iterative and is covered in three phases:

Discover Phase. The result of the Discover Phase is a deliverable with a business assessment and the potential value within a range for the business. This is in the form of recommendations to increase the value of the business. Discover also provides a gap assessment which is the difference between what you may need to meet your retirement objectives and the value that the business can add to meet those objectives. Finally, but not least of which is an assessment of your personal readiness. What is the next step or chapter in the post business ownership life?

Prepare Phase. This phase involves deciding which of the recommendations developed in the Discover Phase are to be adopted. These recommendations could involve the business or the owner’s personal situation. Remember we are looking to improve upon the results of failed business sales or unhappy owners who sold a business. Recommendations are usually adopted in 90 day sprints and at the end of the 90 days an assessment is made as well as a Decision.

Decision Phase. Simply put the owner makes a decision on what to do next. The business improvements may make the business easier to operate – and reduce the desire to exit at that time. The financial gap analysis may need to be closed further or the owner may decide to start another 90 day sprint or simply move towards formally exiting the business.

The Value Acceleration Process is an integral part of exit planning, but it is also the same discipline that will create a more valuable business for the owner that is easier to operate.